Rigid Food Packaging Market Size, Trends, Segments, Share and Companies 2025-35

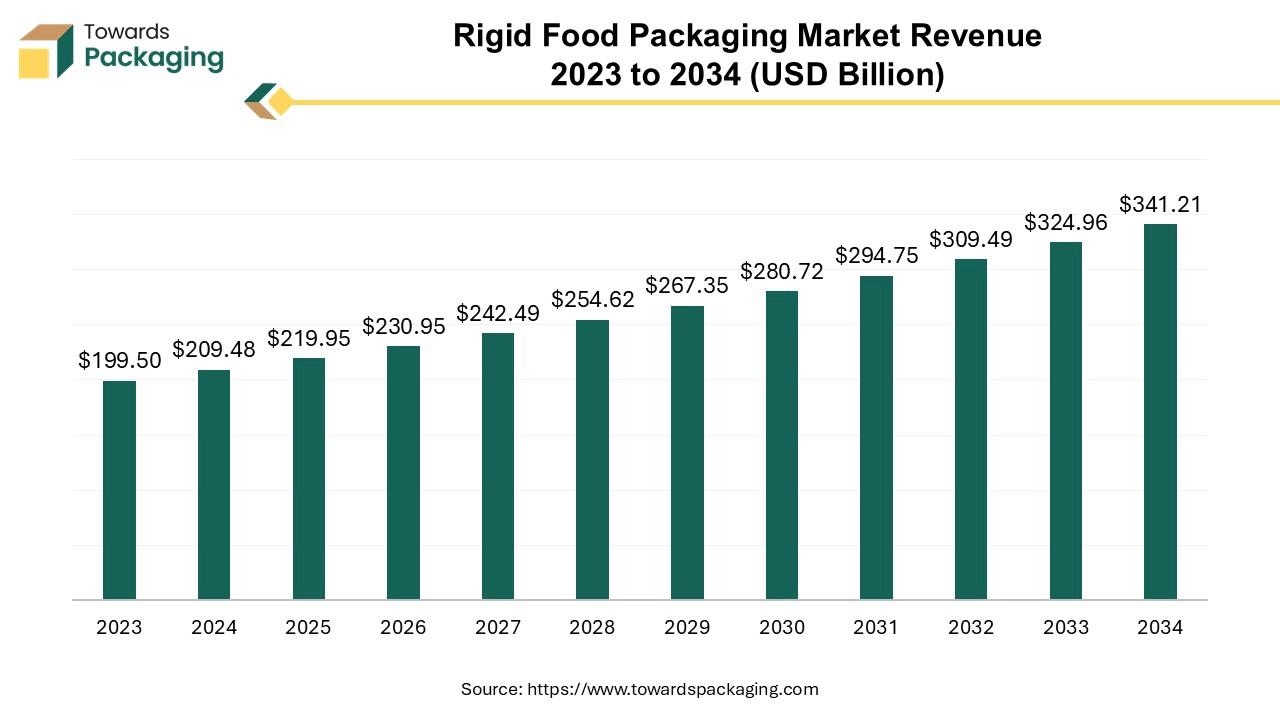

According to projections from Towards Packaging, the global rigid food packaging market is set to increase from USD 219.95 billion in 2026 to nearly USD 341.21 billion by 2034, reflecting a CAGR of 5% during 2025 to 2034.

Ottawa, Nov. 25, 2025 (GLOBE NEWSWIRE) -- The global rigid food packaging market was assessed at USD 219.95 billion in 2025, with projections indicating an increase to USD 341.21 billion by 2034, based on insights from Towards Packaging, a sister firm of Precedence Research. The rigid food packaging market is significant because it offers superior product protection, safety, and even shelf-life by shielding food from contamination and damage.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Rigid Food Packaging?

Rigid food packaging is a firm, non-flexible container that holds its shape, offering durable protection for food and beverages. Common materials involve glass, metal, plastic (such as bottles and jars), and paperboard. These containers are thus structurally stable and protect contents from impacts as well as temperature changes. It also improves brand identity and marketing via opportunities for unique shapes and designs and even supports consumer convenience by allowing on-the-go consumption, efficient handling, and storage.

Key Private Industry Investments in the Rigid Food Packaging Industry:

- CD&R acquisition of Sealed Air Corporation: Private equity firm Clayton, Dubilier & Rice (CD&R) agreed to acquire Sealed Air for approximately $6.2 billion, taking the publicly traded company private and consolidating packaging expertise within its portfolio.

- Amcor combination with Berry Global (ongoing): Amcor is in the process of an all-stock combination with Berry Global to create a global packaging leader, targeting significant annual synergies and a strengthened market presence.

- International Paper acquisition of DS Smith: International Paper completed its acquisition of DS Smith for $9.9 billion, aiming to strengthen its position in sustainable, fiber-based packaging solutions, including those for cold chain logistics.

- MPE Partners' formation of a new food packaging platform: Private equity firm MPE Partners formed a new food packaging platform by investing in and merging Central Coated Products and Sun America to specialize in custom wax paper and plastic container solutions for food processors.

- Mold-Tek Packaging plant expansions: Mold-Tek Packaging, an Indian rigid plastic packaging company, expanded its manufacturing capacity by opening three new production units with an investment of over $14 million to meet increasing domestic demand.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5282

What are the Latest Trends in the Rigid Food Packaging Market?

-

Digital Printing and 3D Technology

They permit personalization, speed up product development, enhance sustainability, and improve product functionality. Digital printing permits high-quality, short-run customized packaging; meanwhile, 3D printing permits the creation of complex features, unique shapes, and the usage of waste materials. Brands can make high-quality, even personalized packaging for niche markets and thus promotions without the minimum order quantities demanded by traditional printing.

-

Sustainability and the Shift to Alternative Materials

Driven by consumer demand and stringent government regulations, there is a strong momentum toward lightweight, recyclable, and reusable solutions. Manufacturers are increasingly adopting materials such as rPET (recycled PET), bioplastics, glass, and paperboard to minimize environmental impact and meet circular economy goals.

-

Integration of Smart Packaging Technologies

The market is seeing increased adoption of features like QR codes, RFID tags, and temperature sensors to enhance product traceability, ensure food safety, and improve supply chain efficiency. These technologies also allow for greater consumer engagement by providing detailed information on product origin and sustainability details.

What Potentiates the Growth of the Rigid Food Packaging Market?

-

Consumer Demand for Convenience and Processed Foods

By creating a demand for packaging that ensures safety, freshness, and even extended shelf life for on-the-go products. Busy lifestyles, urbanization, along with the rise of e-commerce and food delivery services, have now amplified the need for durable, tamper-evident, and even portable packaging solutions, such as microwavable containers and vacuum-sealed packs. Processed foods depend on packaging to maintain freshness, protect against hazards, and extend shelf life, making rigid packaging important for preserving product quality and safety.

More Insights of Towards Packaging:

- Carbonated Soft Drinks (CSD) Packaging Market Size, Trends, Segmentation, Regional Insights, Competitive Landscape, Value Chain & Trade Analysis

- Corrugated Boxes for Transit Packaging Market Size, Trends, Segments, Regional Outlook, Competitive Analysis & Forecast to 2034

- Pre-Qualified Thermal Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape Analysis

- Skincare Primary Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Multi-functional Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Colour Changing Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Packaging Inspection Systems Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Disposable Food Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Molded Fiber Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Commodity Plastics Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Packaging Additives Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Beverage Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Digital Textile Printing Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- U.S. 503B Compounding Pharmacy Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

-

Biologics Drug Packaging Market Size, Trends, Segments, Regional Outlook, Competitive Landscape, and Trade Analysis

Regional Analysis

Who is the Leader in the Rigid Food Packaging Market?

Asia-Pacific leads the market because of its strong production capabilities, lower production expenses, rapidly rising population, expanding middle class, and even booming e-commerce and food & beverage sectors. Further, rapid industrialization, urbanization, as well as the expansion of a middle class in countries like China and India have contributed to increased user spending on packaged goods, mainly food and beverages.

China Rigid Food Packaging Market Trends

The rigid food packaging industry in China is boosted by the growing e-commerce and food/beverage sectors, which are propelled by urbanization and increasing incomes. Key trends involve a shift towards sustainable materials such as bioplastics and recycled content, the acceptance of "smart" packaging with features such as QR codes, lightweighting for expense reduction, and innovations in recycling technologies.

India Market Trends

Key trends include the usage of advanced materials such as PET and PP, a growth in e-commerce and even food delivery packaging, and a shift towards eco-friendly options like bioplastics and recycled content, via plastic remains the dominant material. Meanwhile, innovations in smart packaging and raised government support for production are also shaping the market.

How is the Opportunistic Rise of North America in the Rigid Food Packaging Industry?

Hectic lifestyles and a rising number of single-person households in North America have boosted a surge in the need for ready-to-eat snacks, meals, and single-serve beverages. Rigid packaging, like bottles, tubs, jars, and trays, is ideal for these products, providing durability and convenience (e.g., resealable options, microwavable trays). Technological advancements targeted at reducing material usage in rigid packaging while managing strength, thus cutting expenses and environmental impact.

U.S. Rigid Food Packaging Market Trends

The U.S. market is driven by the need for convenience and e-commerce, which favors durable packaging such as rigid plastic, metal, and even glass containers. Key trends include a strong target on sustainability via recyclable materials and even lightweighting, advancements in active and also intelligent packaging (e.g., QR codes), and increasing usage of PET and injection-molded products, mainly for beverages and food containers.

Canada Market Trends

Growing urban populations are driving the need for convenient, portable packaging solutions, mainly in the food and beverage sectors. The growing consumption of convenience foods, which need long shelf life and protection, fuels the demand for rigid packaging.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Material Insights

Why did the Plastic Segment Dominate the Rigid Food Packaging Market in 2024?

This is because of its lightweight, durability, and even cost-effectiveness. It offers superior protection against moisture, oxygen, and also physical damage, which helps extend shelf life and reduce waste. Meanwhile, plastic can be molded into a huge array of shapes and sizes, supporting complex designs that improve branding and appeal to consumers. Materials such as PET are mainly favored for their clarity and strength.

Packaging Type Insights

Why did the Boxes & Cartons Segment Dominate the Rigid Food Packaging Market in 2024?

Due to their cost-effectiveness, sustainability, and even versatility, which are vital for both protection and branding. They provide superior durability for shipping and also e-commerce, are easily customizable, and advantage from growing consumer need for recyclable and biodegradable options. Boxes and cartons can be adapted for numerous purposes, from bulk shipping to individual user retail packaging. For instance, some are programmed with holes for air circulation to prevent manufacturing from rotting, while others are built for stability in e-commerce.

Application Insights

Why did the Meat, Poultry & Seafood Segment Dominate the Rigid Food Packaging Market in 2024?

Due to the high requirement for these products, driven by factors such as rising income, urbanization, and even shifting dietary patterns, which necessitate robust packaging for freshness and even safety, Rigid packaging is important for protecting these perishable items from moisture loss, contamination, and physical damage, while extending their shelf life via features such as modified atmosphere packaging.

The increasing demand for convenience foods, propelled by busy lifestyles and the growth of e-commerce, also fuels the demand for easy-to-open, portion-controlled, and even transit-safe rigid packaging for these protein-rich products.

Recent Breakthroughs in the Global Rigid Food Packaging Industry

- In March 2024, 3M unveiled a groundbreaking innovation targeted at transforming shipping and packaging. This new product is programmed to improve sustainability and efficiency in logistics, addressing the rising need for environmentally friendly solutions. By incorporating advanced materials and technologies, 3M's innovation promises to decrease waste and enhance the overall shipping procedures.

Top Companies in the Rigid Food Packaging Market & Their Offerings:

- Crown Holdings, Inc. primarily provides metal packaging solutions, including steel and aluminum cans, for a wide array of food products.

- Mauser Packaging Solutions focuses on providing intermediate bulk containers (IBCs), pails, and drums for bulk handling and shipping of liquid and solid food ingredients.

- Berry Global Inc. manufactures a vast range of rigid plastic containers, such as bottles, jars, cups, tubs, and pails, for consumer and foodservice applications.

- Silgan Holdings Inc. is a leading supplier of metal food containers in North America and Europe, as well as custom-designed plastic containers and dispensing closures.

- Sonoco Products Company specializes in rigid paper containers, also known as composite cans (like the EnviroCan™), which are made from recycled fiber and used for products such as infant formula, coffee, and snacks.

- Pactiv LLC manufactures and distributes a broad portfolio of food merchandising and foodservice products, including various thermoformed trays and containers made from materials like expanded polystyrene and recyclable polypropylene.

- Printpack offers specialty rigid plastic packaging, including cups, trays, and tubs, often with advanced barrier technologies, for both dry and liquid food applications.

- ITC Packaging is a prominent manufacturer of rigid plastic packaging, specializing in customized solutions (like injection-molded containers) for the food, personal care, and household cleaning sectors.

- DS Smith provides fibre-based, corrugated cardboard packaging solutions, including plastic-free, temperature-controlled boxes for cold chain logistics and trays designed to replace traditional plastic or wax-coated boxes for fresh produce and poultry.

- WestRock Company (now Smurfit Westrock) offers paper-based rigid boxes and corrugated containers engineered for durability in demanding supply chain environments, serving as a sustainable alternative to plastic packaging for refrigerated and frozen foods.

- Sealed Air Corporation (doing business as SEE) is known for its innovative Cryovac brand food packaging, which primarily uses thin, high-barrier flexible films and form-fill-seal systems to extend the shelf life of fresh proteins, liquids, and other food products.

Segments Covered in the Report

By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Bagasse

By Packaging Type

- Boxes & Cartons

- Trays & Clamshell

- Bottles & Jars

- Cans

- Cups & Tubs

- Others (Bowls, Cutlery)

By Application

- Meat, Poultry & Seafood

- Dairy Products

- Bakery & Confectionary

- Ready-to-eat Food

- Baby Food

- Produce Food

- Other Foods (Spices, Sauces)

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5282

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Medical Tubing and Catheters Market Size, Trends, and Segments Analysis (2024-2035)

- Food Packaging Films Market Size, Trends, Segments, Regional Insights, Trade & Value Chain Analysis 2024-2035

- Vial Cap Sealing Machine Market Size, Trends, Segments, Regional Outlook, Competitive Landscape, and Global Trade Analysis

- Plastic-Free Packaging Market Size, Trends, Regional Insights, Segmentation, and Competitive Landscape Report

- Plastic Bottles and Containers Market Size, Trends, Segmentation, Regional Insights, Competition, Value Chain & Trade Analysis 2025-2035

- Plastic Bottles and Containers Market Size, Trends, Segmentation, Regional Insights, Competition, Value Chain & Trade Analysis 2025-2035

- Glass Container Market Size, Trends, and Regional Insights: Analysis of Key Segments and Competitive Landscape

- Premium Packaging Material Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Value Chain Analysis

- Lubricant Containers Market Size, Trends, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2035

- Beverage Packaging Machine Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis

- Die-Cut Boxes Market Size, Trends, Segmentation, Regional Outlook, Competition & Trade Analysis 2025-2035

- Smart Containers Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive Landscape & Value Chain Analysis

- Pharmaceutical Packaging Machines Market Size, Trends, Segments, Regional Insights, Competitive Landscape and Global Trade Analysis

- Plastic Airless Packaging Market Size, Trends, Segmentation, Regional Insights, Competitive Landscape & Value Chain Report

-

PET Rigid Plastic Packaging Market Size, Trends, Segmentation Insights, Regional Outlook, and Competitive Landscape

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.